The Indian Partnership Act’ of 1932, Section 4 mentions the rules, regulations, and laws of a partnership firm. According to the Act, a partnership firm is defined as “The relation between individuals who have agreed to share the profits and losses of the business.”

The Indian Partnership Act’ of 1932, Section 4 mentions the rules, regulations, and laws of a partnership firm. According to the Act, a partnership firm is defined as “The relation between individuals who have agreed to share the profits and losses of the business.” The steps required for LLP Registration Online in Delhi must be followed in an appropriate manner for a successful registration.

Limited Liability Partnerships are suited for small business owners and businesses that are not the capital incentives. It is also for individuals who are planning to start a company with a minimum investment amount.

Minimum requirements for LLP Registration

- A minimum of two designated partners,

- One of the partners must necessarily be an Indian resident,

- All the designated partners must have Designated Partners Identification Number(DPIN),

- All the designated partners must obtain Digital Signature Certificate (DSC),

- The applicant must present an address proof of the office which can be either a residential or commercial place.

Types of Partnership Companies

The partnership companies are categorized into four types as mentioned below:

- General Partnerships(GP)

- Limited Partnerships(LP)

- Limited Liability Partnerships(LLP)

- Limited Liability Limited Partnerships(LLLP)

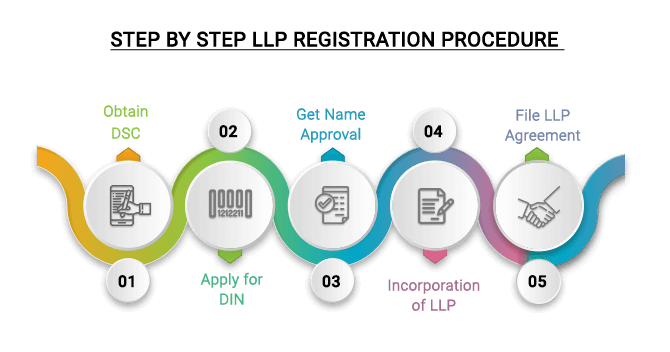

Steps for Limited Liability Partnership Registration Process

The registration process for LLP Company must be obtained by any individual who is planning to start an LLP. LLP Company Registration Process in Delhi is an essential process that is followed by individuals taking the rules and regulations into consideration.

- Obtain the Digital Signature Certificate (DSC): The first step in the LLP Registration process is to attain DSC of the proposed designated partners. The applicants can use the DSC obtained to file ROC compliance forms, LLP registration, and tax returns.

- Obtaining DPIN: Obtaining DPIN (Designated Partner Identification Number) is important for every designated partner who is going to be a part of the LLP. It is as important as obtaining DIN and DSC.

- Company Name Approval: After obtaining DSC and DPIN, the next step is to file for the company’s name approval. An applicant can file for name approval through LLP RUN to ROC (Registrar of Companies).

- Filing of Incorporation application in e-form FiLLiP: After getting an approval from the ROC approves for the company name, the applicant needs to file an incorporation application in e-form FiLLiP. The incorporation form includes the details of the proposed designated partners and requires all the essential documents as attachments.

- Filing LLP Agreement: The LLP agreement is a contract agreed and signed by the partners which display the rights and duties of the partners. The partners can file the LLP agreement online in Form 3 on the MCA portal within 30 days from the date of incorporation. Further, the agreement must be duly signed on a stamp of Rs 10.

Documents required for Limited Liability Partnership Registration

- From all the Designated Partners

- PAN card copy of the designated partners,

- Aadhaar card copy of the partners,

- Address proof which includes latest telephone bill, bank statement, etc.,

- Identity proof of the partners such as Passport or Driving license or Voter’s ID card at the time of incorporation,

- Passport-size photograph of every director and shareholder,

- If one of the partners is an NRI or foreign national, then that individual must present the notarized passport.

- For the proposed registered office (Residential or Commercial)

- Latest address proof of the registered office such as the electricity bill or water bill or landline bill or property tax receipt,

- If the office is on a rented place, a No-Objection Certificate(NOC) from the owner is mandatory,

- A copy of the Notarized Rental Agreement, if the property is rented.

Benefits of LLP Company Registration

A Limited Liability Partnership serves many benefits, which is why it is the type of company preferred by many individuals. The various benefits it serves are:

- Low Registration cost

- Restrictions on the Investment amount are minimum

- An audit is not required or mandatory

- Minimal Compliances to follow

- Non- applicability of Dividend Distribution Taxation

- Perpetual Existence

- Low Registration cost: The cost of registration for Limited liability partnerships is less as compared to other companies which makes it easier for individuals to start an LLP.

- Minimal restrictions on the investment amount: The investment amount is not fixed, it is flexible, thus the partners can contribute any amount. They can only contribute tangible, movable, steady or intangible property.

- An audit is not an essential requirement: LLP companies do not have to follow the regular auditing process. On the other hand, companies like private limited, public limited and other types of companies must have appropriately maintained audited accounts.

- Minimal Compliances to follow: There are no specific set of compliances for Limited Liability Partnership companies, which makes the functioning of the LLP less complicated.

- Presence of Perpetual Existence: The company is a separate entity, that is distinct from its owners. This means that it is going to continue its business activities even if one or more partners of the company leave, resign or is terminated from the company.

Source: https://medium.com/@singhparul/what-are-the-requirements-for-llp-registration-in-delhi-d0ba8ad77783