Peptide Therapeutics: Contract API Manufacturing-Current Market Landscape

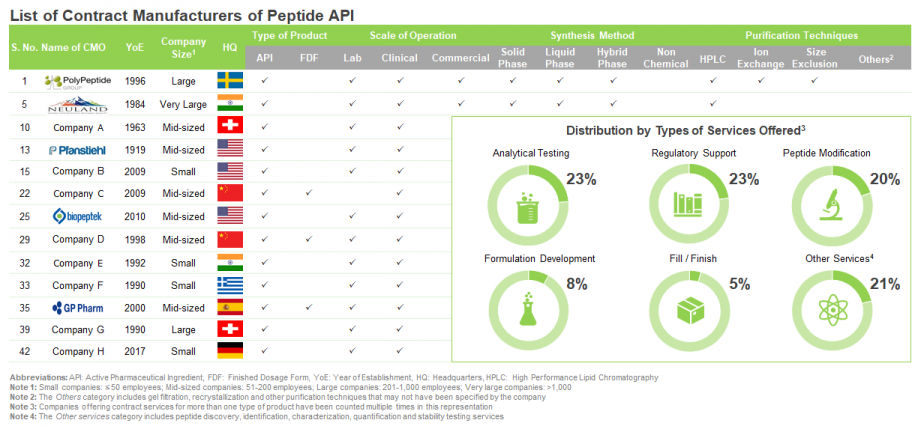

Over the years, the peptide therapeutics domain has evolved significantly. In fact, till date, more than 60 peptide therapeutics have been approved across different parts of the globe. However, the upsurge in demand for such treatment modalities has compelled developers to outsource some key operations, specifically the complex manufacturing process, to contract service providers, which enable reduction in cost as well as overall time to market. During our research, we identified over 50 CMOs that are actively involved in the production of therapeutic peptides. It was further observed that more than 85% CMOs engaged in this domain claim to offer services for peptide APIs, while 46% players have the required capabilities for the manufacturing of both peptide APIs and finished dosage formulation (FDF). Further, companies offering only peptide FDF manufacturing services are (in alphabetical order) Ajinomoto Bio-Pharma, Baccinex, ChemPartner and UPM Pharmaceuticals. Further, the peptide contract manufacturing market is presently dominated by the presence of mid-sized companies (between 51 to 500 employees) and small companies (less than 51 employees), which collectively capture more than 70% of the dataset. In addition, the domain features the presence of some large / very large CMOs. Examples of companies that have more than 1,000 employees include (in alphabetical order) Asymchem, CordenPharma, Neuland and STA Pharmaceutical.

Peptide contract manufacturers across the globe differ in their working capacities and can supply products at different scales. Here, the CMOs have been categorized based on their ability to offer services at the preclinical, clinical and / or commercial scales. It is worth highlighting that more than 65% players engaged in this domain claim to have the required capabilities to manufacture peptide APIs at all scales of operation. This indicates that stakeholders are actively striving to adopt the one stop shop model and provide end to end services to customers worldwide. Examples of companies that offer services for clinical and commercial scale manufacturing include (in alphabetical order) Anaspec, BCN Peptides, Chemi Peptide and CPC Scientific.

Manufacturing processes for peptides require the use of different synthesis methods, such as chemical (liquid phase synthesis, solid phase synthesis and hybrid phase synthesis) and non-chemical synthesis. Majority (80%) of the CMOs engaged in this domain manufacture peptides using the chemical synthesis methods; of these, solid phase synthesis (41%) emerged as the most preferred method for peptide manufacturing, followed by solution phase (39%) and hybrid phase synthesis techniques (15%). This was followed by players that use the non-chemical synthesis methods, including the recombinant approach. It is important to highlight that three companies claim to have the required capabilities to manufacture peptides using both chemical and non-chemical approaches; these are (in alphabetical order) Bachem, Bio-Synthesis and CBL.

A range of peptide purification techniques / methods are used in order to produce high quality peptide drug products and substances. Majority (51%) of the CMOs engaged in this domain use high-performance liquid chromatography (HPLC) for the purification of the manufactured peptides. This is followed by players using ion-exchange and size-exclusion chromatography for purifying their therapeutics products. It is important to highlight that five companies claim to have the required capabilities to purify manufactured peptides using all types of purification technologies; examples include (in alphabetical order) Almac, Chinese Peptide and Novetide.