In Order to Cope up with the Current and Future Market Demand, Chinese Biopharmaceutical Contract Manufacturers are Actively Investing and Collaborating to Expanding their Existing Infrastructure and Capabilities

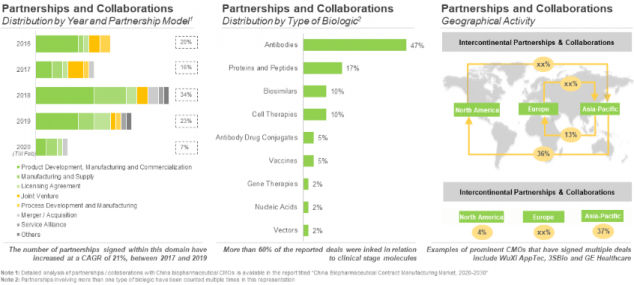

In the pharmaceutical industry, stakeholders are known to adopt a variety partnerships and expansion models. Such initiatives not only allow the companies to expand their respective product / service portfolio, but also to gain additional capabilities in emerging technologies. In the biopharmaceutical contract manufacturing service domain in China, nine different types of partnership deals were found to be inked between different stakeholders. These include, joint venture, licensing agreement, manufacturing and supply agreement, merger / acquisition, process development and manufacturing agreement, product development and manufacturing agreement, product development and commercialization agreement, service alliance and others.

During our research, we came across several partnership agreements, inked during the period 2016-2020 (till February). Of these, the maximum number of partnerships were recorded in 2018 (26) amongst these, 14 agreements were signed in the second half of the year. Further, majority of the partnerships signed in the past two years within this domain were (in decreasing order of number of instances) product development and commercialization agreement (7), product development and manufacturing agreement (4), and manufacturing and supply agreement (4).

In addition, most of the partnerships (46%) were signed for the development / manufacturing of antibodies, specifically monoclonal antibodies, primarily those intended for the treatment of oncological and autoimmune disorders. This can be attributed to China’s advances and improved technical capabilities that ensure development of monoclonal antibodies having high expression and specificity.[1]

Most of the agreements (38%) were signed between industry players located in the same region, Asia-Pacific. Furthermore, in most of the intercontinental agreements, the leading collaborator was a player based in North America (32%). This was followed by agreements, wherein companies (leading partner) from Asia-Pacific have collaborated with players based in Europe (16%).

The field has also witnessed various expansion initiatives undertaken by industry players during the period 2016-2020 (till February). Of these, over 80% of the total expansion initiatives were carried out in the last three years; of these, most of the instances were focused on establishment of a new facility (77%), followed by those undertaken for capability expansion (14%).