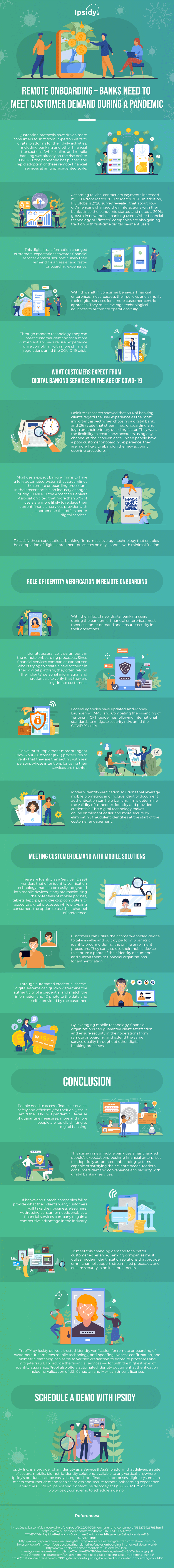

The coronavirus pandemic has driven significant changes in how people conduct their daily activities, including banking and other financial transactions. Quarantine protocols imposed to keep the COVID-19 infection rate down forced consumers to turn to online platforms when accessing financial services.

According to FIS Global's 2020 survey, about 45% of Americans have shifted from in-person bank visits to digital platforms for their financial transactions. It has also noted that there was a 200% increase in new mobile banking users and an 85% rise in mobile banking traffic. Consequently, as the pandemic pushed for the rapid adoption of remote platforms, other fintech companies gained traction with first-time digital payment users.

The unprecedented migration to the digital world and the rapid adoption of remote financial services changed customers' expectations for financial services organizations, primarily their demand for a seamless onboarding and better user experience.

To satisfy these expectations and achieve compliance with more stringent regulations amid the global health crisis, financial organizations must reassess their policies and simplify their services to have a more customer-centric approach. They also need to leverage modern identity verification and identity document authentication solutions to automate their operations fully.

Identity assurance is crucial in the remote onboarding processes. Since companies cannot see if the ones registering for their services are legitimate customers, they often rely on their clients' provided personal information and credentials to verify their claimed identity's legitimacy.

Banking institutions and fintech companies must employ a more stringent Know-Your-Customer (KYC) procedure to verify that the client they are transacting is not a fraud. They must also replace outdated, manual checks with modern identity verification solutions that utilize mobile biometric identity verification technology and automate identity document validation.

Enterprises can employ mobile facial biometric verification technology for remote onboarding to help them confirm a person's claimed identity more efficiently and securely. It allows customers to use their device's camera to take a selfie and undergo a liveness confirmation test to complete a facial recognition scan for biometric identity proofing. Using the same electronic device, they can capture a photo of their identity documents and submit them to their respective banks for authentication.

Accordingly, through automated credential checks, financial organizations can increase the efficiency and accuracy of their identity verification processes for enrollment procedures. Digital systems can quickly verify a credential's authenticity and match the information and ID photo to the customer's provided data and selfie.

Apart from guaranteeing client satisfaction and ensuring their remote onboarding operations' security, companies using modern identity proofing solutions can extend the same service quality throughout other digital banking processes, such as login procedures.

Modern solutions that adhere to FIDO 2.0 standards can help banking institutions improve their online services, meet their customers' demand for a better user experience, and reduce cybersecurity risks. They can invest in FIDO2 authentication solutions for passwordless login, enabling their users to replace their passwords with stronger cryptographic login credentials that allow them to quickly and conveniently authenticate into their accounts.

FIDO 2.0's cryptographic login credentials are not easily stolen or shared with other individuals. These on-device credentials often cannot be unlocked without a second factor or device-based authentication, such as facial biometric authentication.

Implementing new remote identity verification and authentication processes will help financial organizations stop bad guys from accessing their networks more efficiently and effectively and enroll good customers with speed. It can also allow them to provide their users a more seamless user experience while complying with regulatory policies.

Because of the COVID-19 and quarantine protocols, practices and trends among consumers have shifted, and enterprises, particularly in the financial industry, must respond quickly to address these changes and gain a competitive advantage in the current business landscape. If banks and fintech companies cannot provide what their clients want, customers will take their business elsewhere.

To know more information on how banks meet customers' demand for convenient and secure digital financial services, see this infographic by Ipsidy.