Due to the impact of oil, the intersection of changing cost structure and price mechanism has had a significant impact on the economy of chemical manufacturer, and reshaped the value creation and competition dynamics. In order to fully understand the impact of oil shock, it is necessary to conduct in-depth analysis on the cost, price and competition structure of a single product chain in each region.

The rapid transformation of producer economy

Due to the impact of oil, the intersection of changing cost structure and price mechanism has had a significant impact on the economy of chemical manufacturer, and reshaped the value creation and competition dynamics. In order to fully understand the impact of oil shock, it is necessary to conduct in-depth analysis on the cost, price and competition structure of a single product chain in each region.

However, dividing costs and prices into three general categories, each with a different meaning of profit, can help to gain a broad understanding. The first is the chain regional combination closely related to oil price and cost. The second is the asymmetric combination of price and cost changes relative to oil price. The third is the chain regional combination which has the least connection with oil price and cost.

Industry leaders can use this simple framework to divide their portfolios across categories and prepare different responses based on categories.

Chain regional combination closely related to oil price and cost

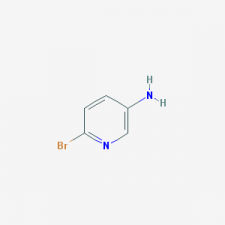

As prices and costs are related to the same underlying commodities, the impact of oil shocks on profit margins will be small, as the changes in prices and costs are roughly the same. However, before the price reaches equilibrium, a chemical manufacturer with excellent commercial and purchasing ability can expand its profits by achieving faster purchasing savings in an environment of falling oil prices. On the contrary, in the environment of rising oil prices, it can improve the profit margin by increasing the price faster than the cost. Benzene is a real commodity chemical produced as a by-product of refineries, and its simple derivatives (such as styrene and polystyrene) are an example of such a chain, because global prices and costs fluctuate with oil prices. Chemical manufacturers can see the profit changes in these chain stores, once impacted by the oil price, because the lag in time is increasing or reducing the cost and transferring it to consumers. However, it should be expected that most of the oil will maintain a relatively independent medium and long-term oil price through cost and profit margin.

Chain regional combination of price and cost change and oil price asymmetry

In some product lines, oil prices have a significant impact on costs and prices in some regions, but not in others. This type of interlocking regional combination tends to see the greatest marginal impact in oil shocks (compression or windfall). In addition, sudden changes in profit margins of chemical manufacturers often lead to postponement or acceleration of ongoing capital projects, thus changing the medium-term balance of supply and demand.

An example of 2014 and 2015 is polyvinyl chloride (PVC). Since PVC prices in different regions are linked by exports, they are often set by global marginal enterprises, which, more recently, are often Asian naphtha producers. Because of this, North American companies that can obtain low-cost shale gas based ethylene have made strong profits in the past few years. As naphtha prices fall in Asia, so do global PVC prices. However, although the price of natural gas in North America has also declined, the decline is smaller than that of naphtha, which is the net effect of profit compression for North American integrated enterprises. Interestingly, as naphtha prices fall, the Asian coal based acetylene route has become a marginal PVC producer. This will prevent PVC prices from falling further and may eventually benefit all other players.

The price of many specialty chemicals is determined by the value in use, while the cost is determined by the oil-based input. They get asymmetric benefits from the low oil price (but correspondingly, when the oil price rises, the profit margin will be compressed).

The combination of oil related chain regions with minimum price and cost

The profits of chemicals whose price and cost are decoupled from oil may be little affected by the impact of oil. For example, some professional lubricant additives are usually priced based on value in use or alternative arbitrage, and they rarely have an oil related cost component. The profits of these chemicals appear to be relatively unaffected by changes in oil prices. Some bio based chemicals follow the same path; in fact, price consistency is one of their main selling points compared to more volatile competitive materials.

It should be noted that while this framework provides a basis for measuring the impact of profit margins on most chains and regions, exceptions may complicate the analysis. Changes in prices and costs may not occur immediately, and pricing mechanisms sometimes range from oil related to oil independent in a specific chain region combination, as shown in the example of PVC.