A foreclosure auction is bartering to sell a house that has been foreclosed. Property preservation companies or real estate owned (REO) companies manage these foreclosed houses

If a property owner can’t finish repayments on their home loan, they obligate to default on the loan. If the owner defaults on the home loan for a rendered months, the bank that initially lent the mortgage holder the cash to buy the property can lawfully repossess it and take ownership. Now, the property is a foreclosure or real estate owned (REO) home. The bank’s essential target to recuperate as much money from the credit as possible rather than collecting land resources. They will always prefer to sell the property as fast as could be expected under the circumstances.

Foreclosure Auction:

A foreclosure auction is bartering to sell a house that has been foreclosed. Property preservation companies or real estate owned (REO) companies manage these foreclosed houses. The bank or moneylender who owns the property is not entitled to profit from auction, and the properties are generally sold at a loss. The benefit goes to the mortgage owner and any other liens that are available on the property. If the foreclosure auction doesn’t work and the property is not sold due to any reasons, it instinctively turns into an REO property.

Why foreclosure auctions usually don’t work?

Many foreclosed properties are not sold at the auction, since they fail to draw any bids. It may appear to be odd in case you are new to such auctions, but it is a general case as the banks and moneylenders do not set the property costs on the ground of property market value. They attempt to cover their loss and expenses, implying that if a property defaults in the initial months it is claimed, the cost of that property could be way above-market price, and due to which no one buys that property. The base offer cost on a foreclosed property includes:

- Balanced unpaid mortgage loan

- Interest

- Lawyer’s fees

- Foreclosure process fees

Types of foreclosure:

- Judicial foreclosure: Judicial foreclosure refers to foreclosure that goes through the judiciary system. The legal foreclosure process starts when the bank documents their claim and file a lis pendens (also known as a notice of pendency of action) on the property. A second notification, the Notice of Foreclosure Sale (NFS), is filed once the court has set the auction time and bid amount.

- Non-judicial Foreclosure: The non-judicial foreclosure process permits a moneylender to advertise and auction the property at a public sale, without court inclusion, by following the rules indicated by the state. As the process as per the state regulations or ordinances, the non-judicial foreclosure process is sometimes also known as Statutory Foreclosure. It entails a demand letter and 30 to 120 days of notice before a definite warning of foreclosure.

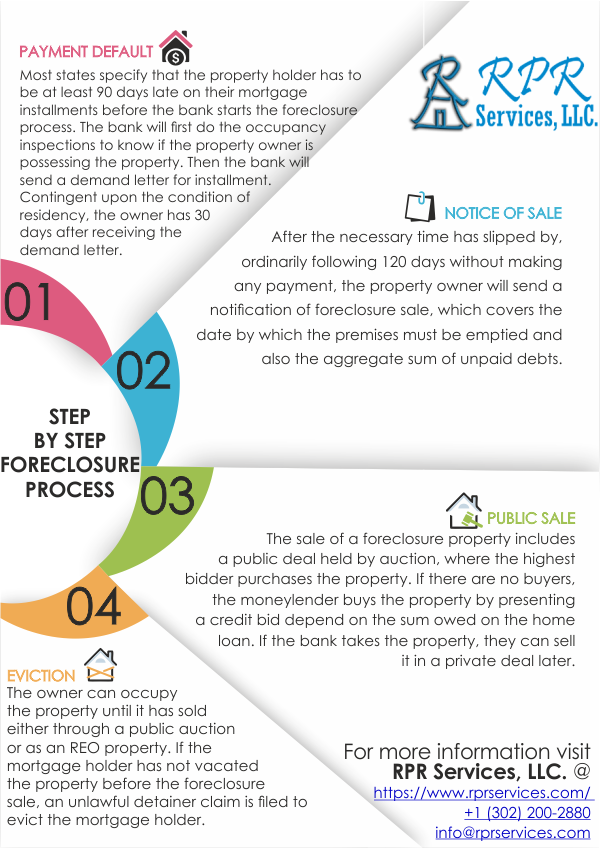

Foreclosure process:

Step 1: Payment default: Most states specify that the property holder has to be at least 90 days late on their mortgage installments before the bank starts the foreclosure process. The bank will first do the occupancy inspections to know if the property owner is possessing the property. Then the bank will send a demand letter for installment. Contingent upon the condition of residency, the owner has 30 days after receiving the demand letter.

Step 2: Notice of sale: After the necessary time has slipped by, ordinarily following 120 days without making any payment, the property owner will send a notification of foreclosure sale, which covers the date by which the premises must be emptied and also the aggregate sum of unpaid debts.

Step3: Public sale: The sale of a foreclosure property includes a public deal held by auction, where the highest bidder purchases the property. If there are no buyers, the moneylender buys the property by presenting a credit bid depend on the sum owed on the home loan. If the bank takes the property, they can sell it in a private deal later.

Step 4: Eviction: The owner can occupy the property until it has sold either through a public auction or as an REO property. If the mortgage holder has not vacated the property before the foreclosure sale, an unlawful detainer claim is filed to evict the mortgage holder. The mortgage owner can request some time to move out of the property, but usually, the bank does not accept the request and may demand to vacant the property right away.

RPR Services is a property preservation work order processing company that understands the certainty of how a foreclosed or an REO property needs to be preserved and well maintained. We provide excellent bids with correct prolixity and the procedures to repair the damages at an REO estate that helps our clients to make profits off of the preservation work from their clients.