Often the confusion lies between whether it is better to opt for a Limited Liability Partnership or a Private Limited Company. This write-up will answer all your queries by highlighting the advantages and disadvantages of LLP Registration Online.

Choosing a business structure is a tedious task and entrepreneurs often get perplexed to find the right Company model that will ensure success. Often the confusion lies between whether it is better to opt for a Limited Liability Partnership or a Private Limited Company. This write-up will answer all your queries by highlighting the advantages and disadvantages of LLP Registration Online.

An overview of Limited Liability Partnership

A Limited Liability Partnership abbreviated as LLP is a recently evolved corporate structure which merges the aspects of Partnership and limited liability. Hence, it provides the flexibility of the former with the benefits of the later. Here are some key characteristics which precisely defines a Limited Liability Partnership Company:

- A Limited Liability Partnership Company has a separate legal entity from its members. Thus, it avails perpetual succession;

- At least two partners are required to incorporate LLP while there is no such restriction on the maximum limit of members;

- There is no need for the minimum capital contribution to register a Limited Liability Partnership firm;

- LLP Agreement assigns the duties and regulates the rights of LLP’s partners & members;

- No partner is liable for the negligence or misconduct of another partner in case of a Limited Liability Partnership;

- Each LLP must maintain the Annual Accounts and it has to be audited if the turnover exceeds INR 40 lakh or if the contribution surpasses INR 25 lakh.

Procedure for LLP Registration

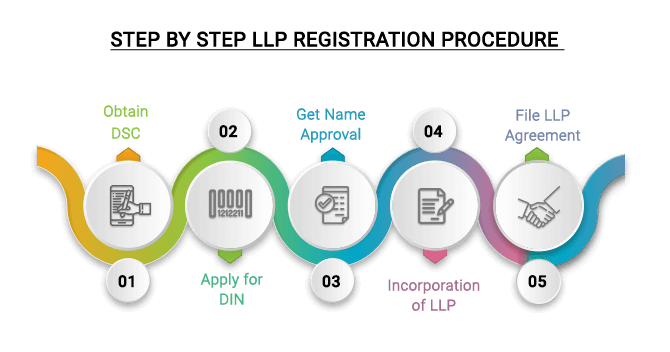

Step by Step LLP Registration Procedure in India

Following the step by step for LLP Registration Procedure:

- Step 1- Acquire the Digital Signature Certificate (DSC)

- Step 2: Apply for DPIN

- Step 3: Get the Company’s Name Approval

- Step 4: File Incorporation Application in e-form FiLLiP

- Step 5: File LLP Agreement in Form 3

Once you pass the eligibility criteria, you have to follow these steps for LLP registration:

Step 1- Acquire the Digital Signature Certificate (DSC)

The first and foremost step is to obtain DSC for all the proposed designated partners. The members can utilize the same DSC to file ROC (Registrar of Companies) compliance forms, LLP registration, and tax returns.

Step 2: Apply for DPIN

The next step includes filing an application for Designated Partners Identification Number (DPIN) in e-form DIR 3.

for more information about this, visit at LLP Registration Procedure.

Advantages of LLP Registration

There are several perks of registering a Limited Liability Partnership which is as follows:

- No limit on the total number of members– One needs to have minimum two members, whereas it can have a limitless number of members, unlike a Private Company that have a maximum limit of 200 members to set up LLP.

- Less ccompliances-A Company is bound to comply with numerous legal stipulations. However, it is not the case with a Limited Liability Partnership wherein the Company has to fill the Annual Returns and maintain a Statement of Accounts.

- Tax benefits- The biggest benefit of LLP Registration is that such business entities leverage Tax exemptions. They are just liable for Income Tax payment without any obligation for Dividend Distribution Tax or Corporation Tax.

Disadvantages of LLP Registration

As a blessing comes with a disguised curse, there are some drawbacks of Limited Liability Partnership as well:

- No access to Equity iinvestment- Unlike a Company, LLP cannot avail Equity investment or shareholdings. Therefore, HNI’s, Venture Capital, Angel investors and Private Equity funds cannot be invented in a Limited Liability Partnership Company. Thus, LLP’s can only depend upon funding from Promoters and Debt funding.

- Higher rate of Income Tax- As LLP’s don’t have to pay any other Taxes except Income Tax, so the rate of interest is quite high. Irrespective of the turnover, LLP’s have to pay a Tax at a 30% rate.

- Penalty imposed for non-compliance- If LLP fails to file Annual Returns, then it has to bear a penalty of INR 100 per day.