The “Antibody Discovery: Services and Platforms Market (3rd Edition), 2020-2030” report features an extensive study of the current market landscape, offering an informed opinion on the likely future evolution in this industry over the next ten years

High target specificity and favorable safety profiles offered by antibody based pharmacological interventions has created a high demand for such molecules; the domain has witnessed an increased inflow of investments and collaboration opportunities.

Roots Analysis has announced the addition of “Antibody Discovery: Services and Platforms Market (3rd Edition), 2020-2030” report to its list of offerings.

Key Inclusions

- An overview of the overall landscape of antibody discovery service providers along with the information on a number of parameters, such as year of establishment, company size, location of headquarters, type of service offered (antigen designing, hit generation, lead selection, and lead optimization and lead characterization), type of antibody discovery method (hybridoma based, library based, single cell based, transgenic animal based, and others), animal model used (rabbit, rat, mouse, llama, chicken, transgenic animal and others), type of antibody discovered (monoclonal antibody, bispecific antibody, single domain antibody, antibody drug conjugate, antibody fragment and others) and purpose of antibody discovery (therapeutic and diagnostic).

- An insightful competitiveness analysis of antibody discovery service providers, based on supplier strength (based on a company's employee count and years of experience) and service portfolio specifications, such as number of antibody discovery services offered, number of antibody discovery methods adopted, and number of subject specific agreements signed.

- Elaborate profiles of antibody discovery service providers. Each company profile features a brief overview of the company, its financial information (if available), antibody discovery service portfolios and an informed future outlook.

- A detailed review of the overall landscape of antibody discovery platforms, along with the information on the technology developers such as year of establishment, company size, location of headquarters and type of antibody discovered (monoclonal antibody, bispecific antibody, single domain antibody, antibody drug conjugate, antibody fragment and others). In addition, the chapter highlights an in-depth analysis of antibody discovery platforms based on type of antibody discovery method (hybridoma based, library-based, single cell-based, transgenic animal-based, and others), animal model used (rabbit, rat, mouse, llama, chicken, transgenic animal and others) and availability of intellectual property.

- A detailed competitiveness analysis of antibody discovery platforms, taking into consideration the supplier power (based on the year of establishment of developer) and key technology specifications, such as type of antibody discovered, compatibility of antibodies in human (fully human or not), availability of patent protection, number of deals signed for a particular platform between 2015 and 2020.

- Elaborate profiles of antibody discovery platform providers. Each company profile features a brief overview of the company, its financial information (if available), details on antibody discovery technology / platform(s) offered and an informed future outlook.

- An assessment of antibody discovery service and platform providers' capability in different regions, based on a number of relevant parameters. For platform providers, these parameters include number of technologies offered, number of antibody discovery methods employed, and type of antibody discovered. On the other hand, the service providers have been evaluated based on the type(s) of service offered.

- An analysis of the partnerships that have been established in this domain since 2015, covering R&D collaborations, licensing agreements, mergers and acquisitions, product development and / or commercialization agreements, clinical trial agreements, and other relevant deals.

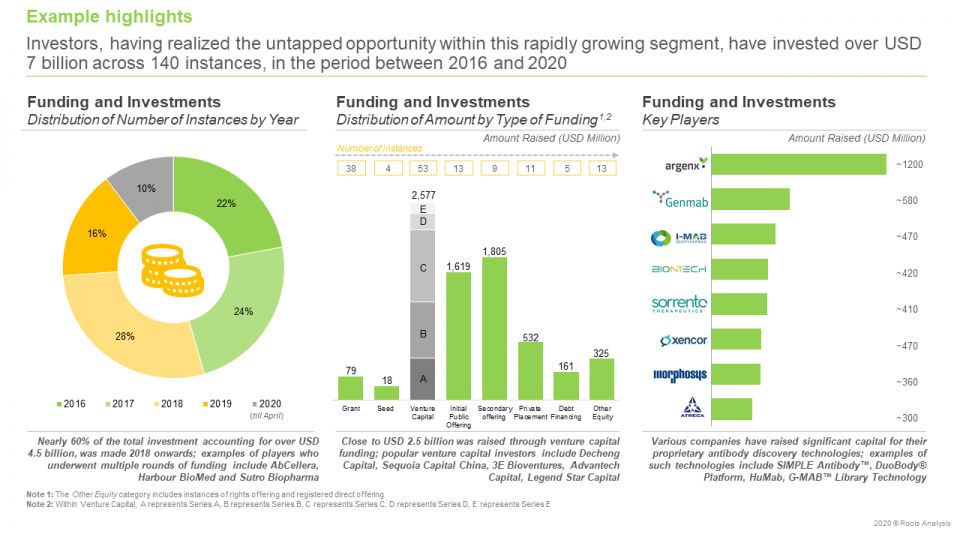

- An analysis of the investments made in this domain, during the period between 2016 and 2020 (till April), including seed financing, venture capital financing, debt financing, grants, capital raised from IPOs and subsequent offerings, in companies that are engaged in the field of antibody drug discovery.

- Detailed profiles on the top five therapeutic antibody products, which have generated the highest revenues. Each profile features a brief overview of the drug, the type of antibody discovery method it employs and the annual historical sales of the product.

- A case study on antibody humanization and affinity maturation, including a list of players that are presently offering such services and platforms, a publication analysis highlighting the research trends in this field and a detailed discussion on other affiliated trends, key drivers and challenges, under a comprehensive SWOT framework.

- A brief discussion on the imminent opportunities (such as novel antibody therapeutics, innovative technologies and other future opportunities) in the field of drug discovery that are likely to impact the future evolution of this market over the coming years.

The report features the likely distribution of the current and forecasted opportunity across important antibody discovery services market segments, mentioned below:

Steps Involved in the Antibody Discovery Process

- Antigen Designing

- Hit Generation

- Lead Selection

- Lead Optimization

- Lead Characterization

Antibody Discovery Method Used

- Phage Display

- Hybridoma

- Transgenic Animal

- Yeast Display

- Single Cell

- Others

Nature of Antibody Generated

- Humanized

- Human

- Chimeric

- Murine

Key Geographical Regions

- North America

- Europe

- Asia Pacific and Rest of the World

The report features the likely distribution of the current and forecasted opportunity across important antibody discovery platforms market segments, mentioned below:

Type of Payment

- Upfront Payments

- Milestone Payments

Key Geographical Regions

- North America

- Europe

- Asia Pacific

The report also features inputs from eminent industry stakeholders, according to whom demand for antibody based therapeutic / diagnostic products have increased the opportunities for service provides and technology developers. The report includes detailed transcripts of discussions held with the following experts:

- Tracey Mullen (Chief Executive Officer, Abveris Antibody)

- Lisa Delouise (Founder and Chief Technology Officer, Nidus Biosciences)

- Mark Kubik (Chief Business Officer, AvantGen)Chun-Nan Chen (Chief Executive Officer and Chief Scientific Officer, Single Cell Technology)

- Giles Day (Co-Founder and Chief Executive Officer, Distributed Bio)

- Kevin Heyries (Co-Founder and Lead of Business Development Strategy, AbCellera)

- Sanjiban K Banerjee (Director, AbGenics Life Sciences)

- Ignacio Pino (Chief Executive Officer and President, CDI Laboratories)

- Jeng Her (Chief Executive Officer, AP Biosciences)

- Thomas Schirrmann (Chief Executive Officer and General Manager, YUMAB)

- Debra Valsamis (Business Development Associate, Antibody Solutions)

- Christel Iffland (Vice President, Ligand Pharmaceuticals)

- Aaron Sato (former Chief Scientific Officer, LakePharma)

For more information, please click on the following link:

About Roots Analysis

Roots Analysis is one of the fastest growing market research companies, sharing fresh and independent perspectives in the bio-pharmaceutical industry. The in-depth research, analysis and insights are driven by an experienced leadership team which has gained many years of significant experience in this sector. If you’d like help with your growing business needs, get in touch at info@rootsanalysis.com

Contact Information

Roots Analysis Private Limited

Gaurav Chaudhary

+1 (415) 800 3415

*********3@carspure.com

When it comes to creating timeless memories for your family, there’s no better choice than Atlanta Family Photographers David and Jess. With nearly two decades of experience behind the lens, this dynamic husband-and-wife duo has mastered the art of capturing real moments, personality, and connections that tell a unique story.