Smartphones have become an integral part of everyday life with the introduction of ever more capable and complex devices in today’s electronics market.

Smartphones have become an integral part of everyday life with the introduction of ever more capable and complex devices in today’s electronics market. Modern phones are packed with the latest technology, allowing a user to perform a range of tasks on an everyday basis.

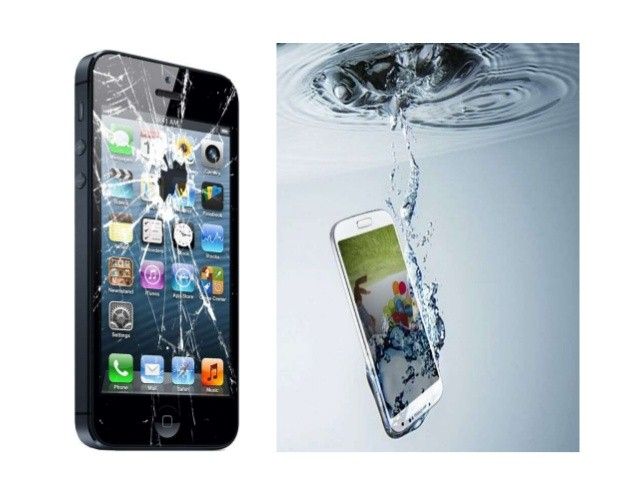

Unfortunately, smartphones have also become incredibly vulnerable to several types of damages. Recent studies conducted by a leading e-commerce site showed that almost 42% of the study group members have damaged their phone's display at some point of time, out of which almost 5% were caused by accidental liquid spillage.

Mobile protection plans

Smartphones packing delicate components may completely fail to work even after minor bumps or accidental drops. Repairing or refurbishing such components can cost a significant sum; depending on the manufacturer and the model of a particular smartphone, screen replacement can cost as much as Rs.10,000 in some cases.

Mobile phone insurance policies have gained significant popularity in recent years as a means to protect a smartphone owner against such unforeseen expenses. These plans offer extensive financial coverage to an insured individual, protecting their smartphones against accidental damages, natural or man-made disasters, and even mechanical breakdowns.

Why purchase a smartphone insurance policy?

- Sum assured – These insurance policies offer a substantial sum assured against affordable premiums, ensuring complete coverage to pay for expenditures witnessed during repairing or replacing a smartphone component.

Mobile protection plan, like the Mobile Screen Insurance policy offered by Bajaj Finserv under Pocket Insurance & Subscriptions, provides coverage of up to Rs.10,000 against a nominal premium.

- Extensive coverage – The best mobile insurance plan offers financial coverage against a variety of scenarios, including special perils like floods, earthquakes, cyclones, riots, strikes, etc. Damages caused during attempts of burglary or robberies are also covered under these policies.

Other than that, any unexpected electrical or mechanical breakdown of a phone screen, as well as liquid damage to the screen is also included under these policies.

Customers can also purchase add-on insurance policies, like a mobile charger insurance plan, to financially protect such accessories against any unwanted damage, further extending the coverage of such policies.

- Simple application and claim settlement process – The application and claim settlement process for a mobile insurance policy offered by a leading insurance aggregator can be completed online, allowing a prospective customer to purchase such a plan in a hassle-free manner. Applicants only have to fill an online form with some basic details to purchase a policy.

Once approved, customers will have to pay the premium via credit or debit card, mobile wallet, net banking, or any other modes of payment, which will complete the mobile phone insurance plan purchase process.

Similarly, policyholders can raise a claim within 24 hours of damage to their phone screen by calling the insurance aggregator’s helpdesk or emailing them with the necessary details. The financial institution might ask for certain documents (like a copy of the original receipt, a receipt indicating the cost of repair, FIR in case of attempted theft or burglary, etc.) while processing the claim; these are usually required to assess the validity and substantiate the claim amount.

Mobile protection plans are exclusively designed to protect against any financial loss while repairing accidental damages. The comprehensive financial coverage offered against a reasonable premium as well as hassle-free application and claim settlement process makes it an attractive financial product.

In addition to the above, customers can also opt for plans like a fitness wearables insurance policy to financially safeguard their smartwatch against theft or accidental damage.

It is also advisable for iPhone users to have insurance plans such as a small gadgets insurance policy in place to financially protect costly accessories like headphones. While typically such insurance policies are quite cheap, coverage offered by them can save substantial finances in case these accessories malfunction or get damaged or stolen. Buying such policies along with the iPhone mobile screen insurance policy can effectively provide complete protection for your iPhone as well as other linked electronic gadgets comprehensively.